Common Options Income Traps

Overview

Most popular income strategies are built as high-probability trades. On paper, that looks great. It gives the appearance of steady, paycheck-like consistency. But in practice, these approaches are often not scalable, structurally fragile, or carry hidden risks.

Take the short put. A solid trade — I use it. But I only trade it cash-secured or with low leverage. The moment higher leverage enters the picture, the position becomes highly vulnerable to tail risk. Even without leverage, many traders implement it in ways that lead to poor returns or outright losses.

Covered calls? They look perfect for stock owners. Who doesn’t like collecting “income” on shares they already own? Again, it’s a valid approach — I use it. But it’s also easy to misuse, and the flaws show up over time.

Then there are the common delta-neutral income trades. On the surface they look stable, even sophisticated. In reality, they often hide risk behind layers of complexity. I trade these too — but only under the right conditions and in the right size.

Let’s walk through the typical scenarios traders run into with each of these methods…

Short Puts Seller / Wheel Trader

Initial Strategy

- The trader sells puts on a stock they don’t mind owning.

- Stock rallies → underperforms.

- 💭“That’s fine, I’m here for income, not growth.”

Stock Declines

- The stock drops below the call strike.

- The trader buys the stock or rolls down/out.

- 💭“No problem, I’ll take assignment — I like this stock anyway.”

Downside Pressure

- The stock keeps falling → The position is losing.

- 💭“It’s temporary. This is a solid company.”

Biases Take Over

- Anchoring & sunk-cost fallacy kick in.

- 💭“Once I’m back to break-even, I’ll get out. I just need to wait it out.”

Break-Even Exit

- After enduring the drawdown, the stock recovers.

- The trader exits near break-even.

- 💭“What a relief… finally out!”

Opportunity Cost

- Meanwhile, the buy & hold investor tolerated the same downside but captured full upside.

- 💭“I went through all that pain… for that small gain.”

Covered Call Trader

Initial Strategy

- The trader owns stock and sells OTM calls for income.

- Stock pulls back → call expires worthless.

- 💭 “Perfect — free money. Let’s do it again.”

Upside Challenge

- The stock surges past the short call.

- The trader rolls the call up/out for small credit.

- 💭 “Nice, I extended my upside and got paid more.”

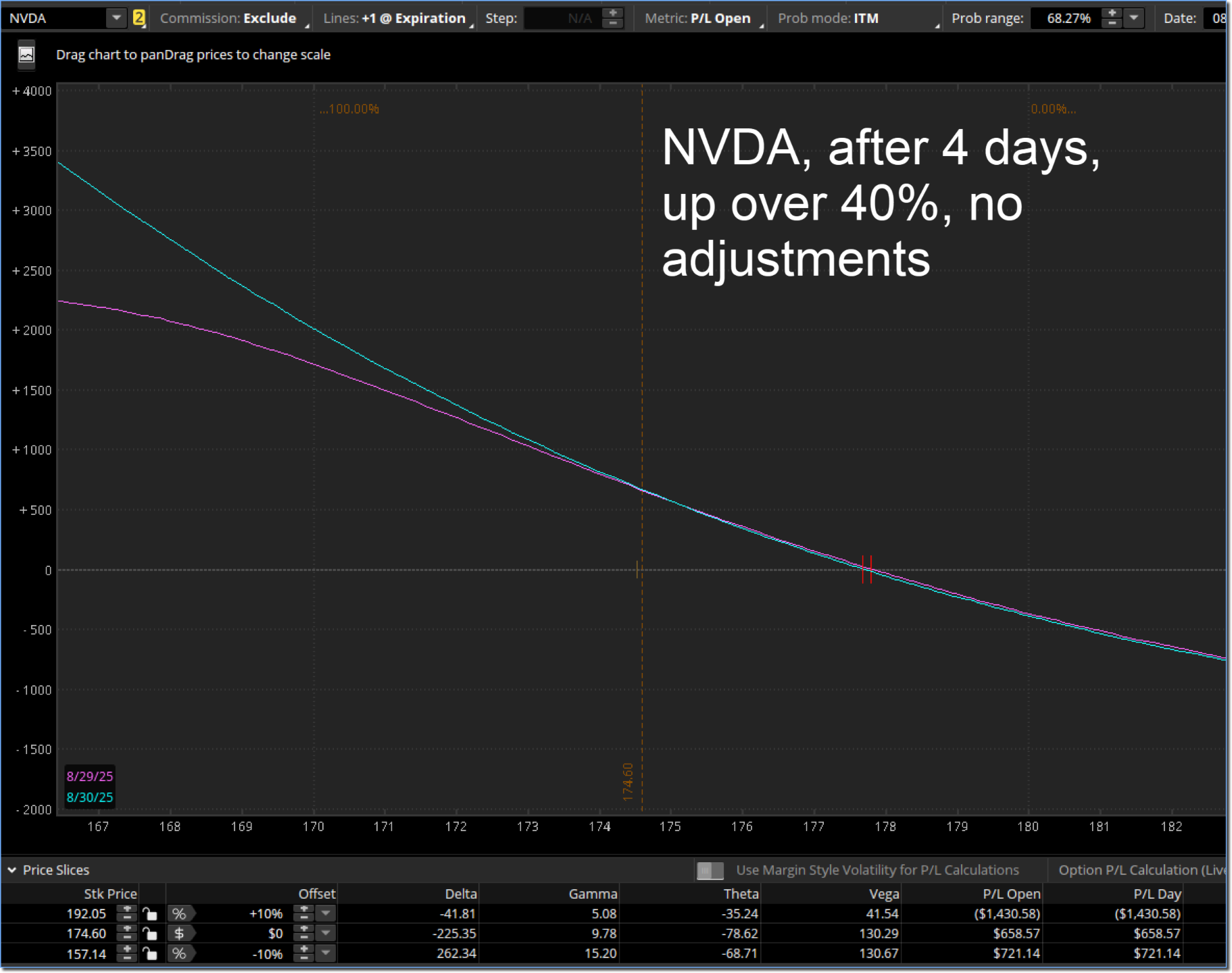

Emotional Conflict

- The stock keeps powering higher → upside capped.

-

💭 “I hope it pulls back… wait, why am I rooting against my own stock?”

Market Shift

- The stock finally drops.

- Call income can’t offset stock losses.

- 💭 “Okay, I’ll just keep selling calls to bring in cashflow.”

Underwater

- The stock falls far below cost basis.

- Premiums no longer meaningful above cost.

- 💭 “I can’t generate enough income here… I’ll just sit and wait.”

Stuck

- Position becomes dead money. Strategy stalls.

- 💭 “So much for consistent income…”

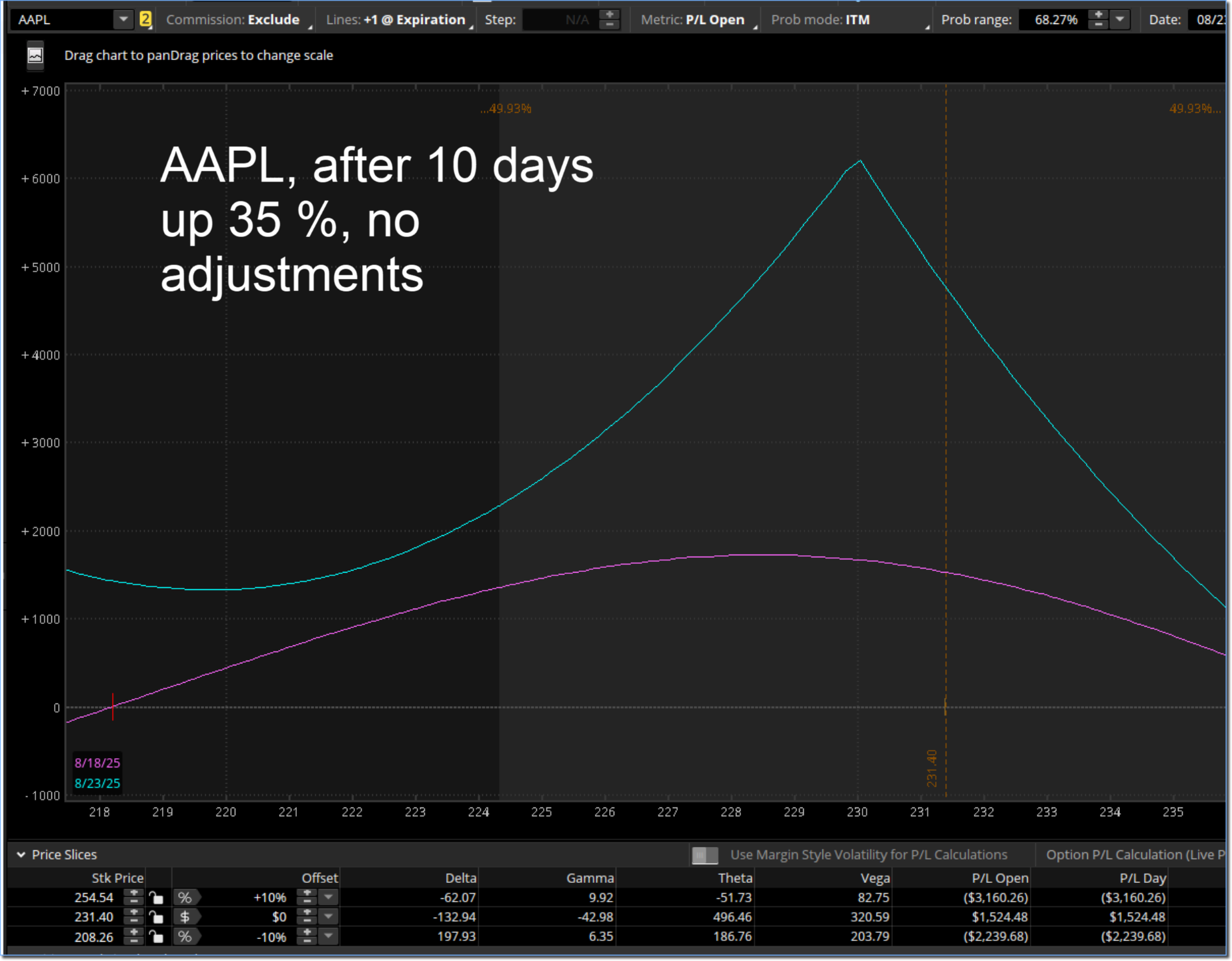

The Delta-Neutral Income Trader

New Discovery

- The experienced trader invents or learn a new trade with a catchy name: The Flying Caterpillar.

- It looks solid and sophisticated.

- 💭“This looks professional — not some gimmick. I may have found something special.”

Impressive Start

- Backtests look strong, recent results shine.

- Safe structure (butterfly, calendar, hybrid)

- It has a profit target and stop loss of 10–15%.

- He starts small to test things out. The trade works. Confidence builds.

- 💭“Wow, it’s simple, consistent, and safe. This could really work.”

Sizing Up

- With small gains building now, he starts scaling up: From 2% to then 20–40% allocation.

- Now the returns are meaningful.

- 💭“Now it’s real money. I can finally scale this up.”

First Market Correction

- Trade gets tested. He is disciplined and sticks with the plan and makes the adjustments.

- It recovers. Ends in a small profit.

- It was stressful and took some work, but it worked.

- Now confidence soars. He just experienced a bad market, and the trade worked!

- 💭“I handled a bad market and still came out ahead. This is bulletproof.”

The Holy Grail Moment

- He now believes he has found the trade for life.

- He runs compounding calculators; he might even manage family money in the future.

- He is now more confident than ever — “I’ve made it.”

- 💭“This is the holy grail. I can trade this forever.”

Second Market Shock

- This one is acting differently. But why? He has done this before, so he sticks with the plan.

- But the trade suffers a large loss this time. This was a nasty correction.

- One big hit wipes away months of gains.

- 💭“What just happened? This was supposed to survive bad markets.”

Market Regime Shifts

- Higher volatility. Trade no longer feels safe.

- Stress grows. Performance weakens.

- Now the trade is much tougher to manage. What is going on? Something has changed.

- 💭“Why is this so much tougher now? Did the strategy break, or is the market's fault?”

Abandon & Replace

- He finally gives up, and the search for another “new” strategy begins.

- Except the next strategy happens to be a recycled version of the same methodology.

- 💭“Okay, that one didn’t work. But this new one… this one looks better.”

Repeat

- Cycle continues: discovery → confidence → holy grail dream → collapse →

- 💭“This time will be different…”

ATS Program - Questions and Answers

- Is it suitable for small accounts? Yes, the system is scalable from small to large accounts

- What level of options experience is required? Intermediate. No fancy greeks; perfect for covered call traders

- Are the rules simple? Yes, very clear rules for systematic entry/exit/management, but also allows for personalization with clear guidelines.

- Can purely mechanical rules work? Yes, many variants do

- Can I customize the system to my needs without breaking it? Yes, the framework allows for selective adaptations

- Does this adapt to different market environments? Yes, the system adapts. It is more than a single complex strategy.

- Will there be community? Yes, and that will be the central component of the program.

- Can I use the strategy if I can't trade during US market hours? Yes, requires minimal monitoring; executions can be planned in advance

- How is the risk managed? This is baked into the core of the system, which enables long-term consistency. I'll explain more in the live event.

- What is the edge this strategy provides? There are several. I will quantify them in the course itself.

- Will there be live trade alerts? The community will include live trade examples for learning purposes, but this is not an alert service.

- Will it help me improve my results? The course will show the 'what/how'. The community will go much deeper into that. The rest is up to you.

- How can I fit this into my current portfolio? There are several ways of using this system. I will cover this important topic in the program.

- Do you trade futures in this program? No, we stay focused and go deep into options strategies that form the ATS System.

- Can I use the system to manage client accounts? The program is for personal use only — but commercial licensing is available by request.