ATS Program – Enrollment Closed

Join the waiting list and we’ll notify you as soon as it opens again.

Adaptive Time Spread System (ATS)

The Next-Gen Options Income System

One Core Method

I've been trading and refining the same core approach for over a decade. It’s been my bread-and-butter across SPX, SPY, QQQ, and a few select stocks, for not just income but also growth. I'm using this system in almost all my account types, from cash retirement to portfolio margin. Over the years, it's evolved from a simple strategy into a refined approach—sophisticated in design but simple in structure & execution—that works for both income generation and long-term growth.

Recent Trade Examples

👉 Click here to see a few of my Recent Trade Examples

Real Trades

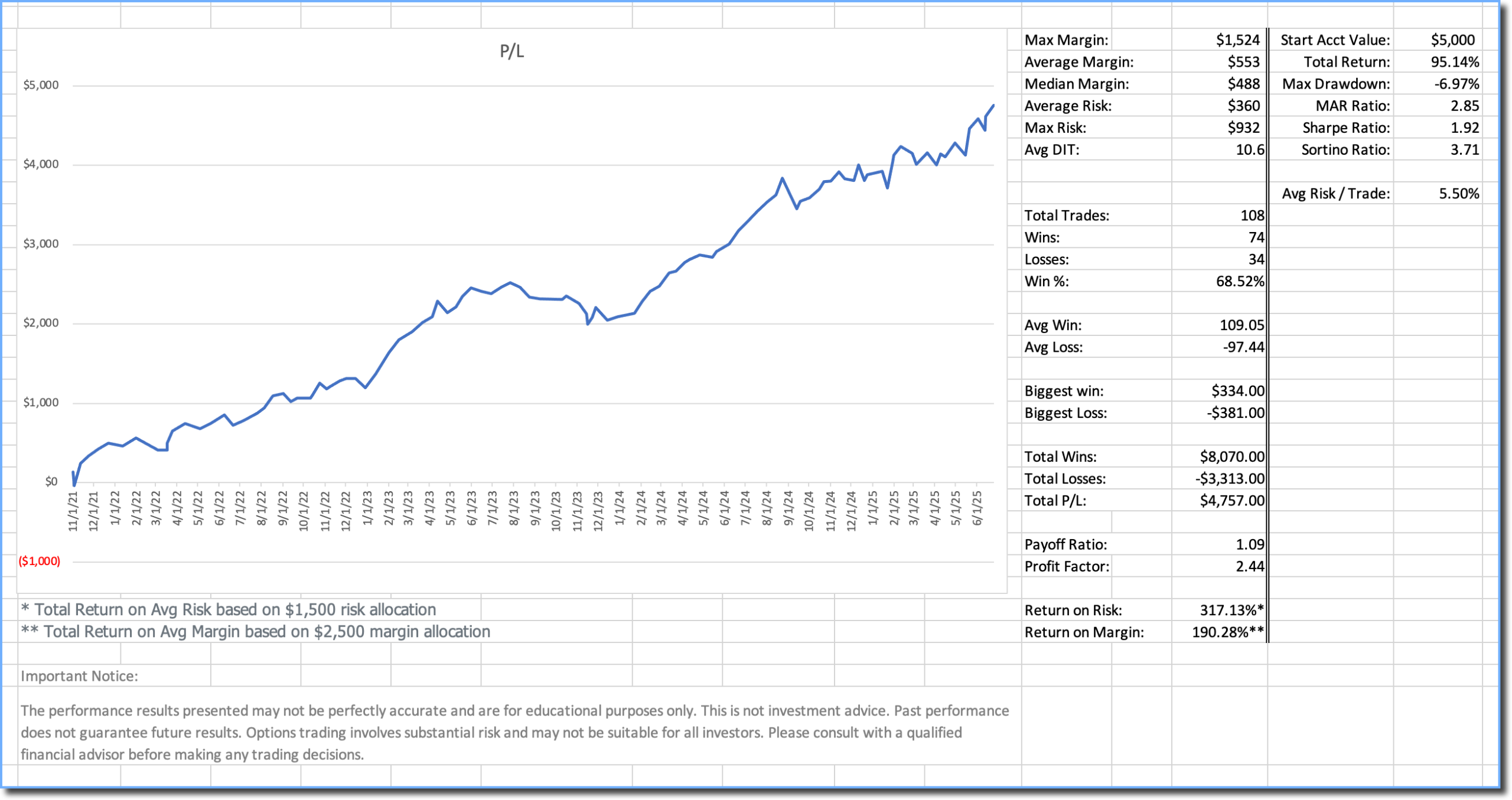

The equity curve below illustrates over 4 years of live trading in my private community using SPY. Since then, I’ve streamlined and further enhanced the strategy, removing friction points and improving its robustness. That refined version is what I’ll be teaching in the new program.

Real Results

The P/L stats below are from actual trades in my private mentoring program, including commissions, slippage, and what I call Trader Drag—the real-world impact of human error (missed entries, late exits, distractions, off days). A truly robust strategy isn’t only profitable in ideal conditions—it can survive (within limits) the inevitable mistakes we all make.

Over a Decade of Consistency

These results are not from an overfitted backtest in perfect conditions, and they don’t promise a “90%+” win rate. They’re based on real trading, with all the warts and mistakes that come with it. My focus is on helping traders become what I call CPTs—Consistently Profitable Traders—on a solid foundation that has been proven over decades.

👉 See a more detailed analysis of the actual trade results: SPY Time Spread Trading Performance Analysis

System Overview

- Many traders start with high probability trades first, then look to manage risk second. That's fine, unless there's a better way.

- I've developed a method that flips that formula.

- Risk first. Probability second.

- I lock in the risk from the start, then increase the probability of winning using precision techniques, without adding complexity.

- Simply setting up defined risk spreads isn't enough; this requires deeper work to make it practical and effective.

The Result

- A balanced blend of win rate and payoff ratio — the sweet spot many strategies miss

- Robust performance across market conditions, stocks, and indexes

- Long-term consistency, not fragile short-term equity curves that look smooth until they break

- Freedom from constant defensive adjustments or forced stop-losses

- A genuine “set it, and let it work” approach — trades designed to perform best when left alone

What it Means

- Refined and strategically simple trades — past the complexity curve without being naively simple

- Lower cognitive load and decision fatigue compared to strategies that need defensive management or rushed stop-loss exits

- Reduced emotional stress since you don't have to defend the trade at the worst possible time

-

Scales naturally with account size — unlike many delta-neutral strategies that tie up large capital, this system is capital-efficient

Common Options Income Traps

- 👉 Find more details here: The challenge with common options income methods

What Traders Are Saying

-

“Your style is one of the best I’ve seen in my trading journey.” — M.K.

-

“I’ve learned something new in every class. You’re the best teacher.” — Dan Z.

-

“Thanks to your mentorship, I finally feel I’m on the right track.” — Soon W.

-

“The wealth of information is amazing. You don’t hold anything back.” — Sanjiv P.

-

“I continue to learn a great deal. The way you develop and explain your process is worth the price of admission.” — David M.

-

“The trade examples you share are easy to follow, and most of the time I even get filled at better prices than you show.” — Ra S.

-

“I’ve got a core system that works — I don’t look for shiny objects anymore.” — Brad H.

-

“Your approach created a seismic shift in my trading psychology.” — Andrew C.

Questions and Answers

- Is it suitable for small accounts? Yes, the system is scalable from small to large accounts

- What level of options experience is required? Intermediate. No fancy greeks; perfect for covered call traders

- Are the rules simple? Yes, very clear rules for systematic entry/exit/management, but also allows for personalization with clear guidelines.

- Can purely mechanical rules work? Yes, many variants do

- Can I customize the system to my needs without breaking it? Yes, the framework allows for selective adaptations

- Does this adapt to different market environments? Yes, the system adapts. It is more than a single complex strategy.

- Will there be community? Yes, and that will be the central component of the program.

- Can I use the strategy if I can't trade during US market hours? Yes, requires minimal monitoring; executions can be planned in advance

- 👉 For the full FAQ, please see: ATS System Questions and Answers